Financial and Managerial Accounting, 3rd Edition

Jerry J. Weygandt, Paul D. Kimmel, and Donald E. Kieso

Financial and Managerial Accounting, Third Edition provides students with a clear introduction to fundamental accounting concepts by introducing them to the building blocks of the accounting cycle and then moving on to financial statements.

This course is ideal for a two-semester Financial and Managerial Accounting sequence where students spend equal time learning financial and managerial accounting concepts and learn the accounting cycle from a corporate perspective.

The next generation of WileyPLUS for Financial and Managerial Accounting gives instructors the freedom and flexibility to tailor content and easily manage their course to keep students engaged and on track.

Schedule a Demo Sign Up for a Test Drive Adopt WileyPLUSWant to learn more about WileyPLUS? Click Here

The expanded video library offers more great content.

Author Paul Kimmel has created more of the popular Solution Walkthrough Videos, providing students with complete coverage of every problem and most frequently assigned exercises. The video library also includes Section Opener Videos, Applied Skills Videos, Excel™ Tutorials, and Managerial Series Videos.

Students experience real-world problem solving.

A new problem design for all assessment and practice questions gives students a clean, blank-sheet-of paper interface. Improved navigation and a more modern design provide students with a more simplified, real-world experience.

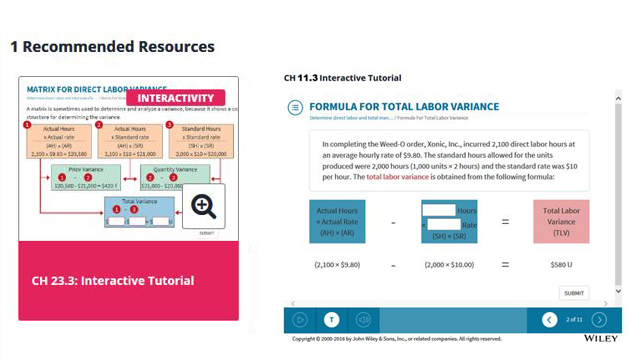

New mobile-friendly interactive tutorials are ideal for students on-the-go.

The popular Interactive Tutorials have been redesigned in an enhanced, mobile-friendly learning environment, giving students the opportunity to study anytime, anywhere.

- Practice Made Simple: The Review and Practice Section has been updated with new brief exercises, including solutions, to provide students with additional practice opportunities.

- Accounting Weekly Updates: Keep you and your students updated and informed on the very latest in accounting news stories. Each week, you’ll receive links to 3-5 news articles, video clips, business news stories, and more with discussion questions to elaborate on the stories during class.

- Expanded Coverage of Managerial Topics: A more modular presentation allows you to make your course more customizable. For example, expanded discussion of incremental analysis, regression analysis, and a new appendix on ABC is provided

- Additional Content: Alternate Sections 5 and 6 allow you to customize your approach to inventory to either periodic or perpetual, and alternate Sections 15 and 16 provide the coverage of costing without debits and credits. Available in WileyPLUS or through Wiley Custom Solutions.

- Accounting Cycle Connections: Students learn how to connect the different steps of the accounting cycle. These connections have been added to the accounting cycle sections and topics for additional emphasis, explanations, illustrations, and homework problems.

Features Include

JERRY J. WEYGANDT, Ph.D., CPA, is Arthur Andersen alumni emeritus professor of accounting at the University of Wisconsin−Madison. He holds a Ph.D. in accounting from the University of Illinois. Articles by Weygandt have appeared in The Accounting Review, Journal of Accounting Research, Accounting Horizons, Journal of Accountancy, and other academic and professional journals. These articles have examined such financial reporting issues as accounting for price-level adjustments, pensions, convertible securities, stock option contracts, and interim reports. Weygandt is the author of other accounting and financial reporting books and is a member of the American Accounting Association, the American Institute of Certified Public Accountants, and the Wisconsin Society of Certified Public Accountants. He has served on numerous committees of the American Accounting Association and as a member of the editorial board of The Accounting Review; he has also served as president and secretary-treasurer of the American Accounting Association. In addition, he has been actively involved with the American Institute of Certified Public Accountants and has been a member of the Accounting Standards Executive Committee (AcSEC) of that organization. He has served on the FASB task force that examined the reporting issues related to accounting for income taxes and served as a trustee of the Financial Accounting Foundation. Weygandt received the Chancellor’s Award for Excellence in Teaching and the Beta Gamma Sigma Dean’s Teaching Award. He is on the board of directors of M&I Bank of Southern Wisconsin. He is the recipient of the Wisconsin Institute of CPA’s Outstanding Educator’s Award and the Lifetime Achievement Award. In 2001, he received the American Accounting Association’s Outstanding Educator Award.

PAUL D. KIMMEL, Ph.D., CPA, received his bachelor’s degree from the University of Minnesota and his doctorate in accounting from the University of Wisconsin. He teaches at the University of Wisconsin−Milwaukee and the University of Wisconsin−Madison. He has public accounting experience with Deloitte & Touche (Minneapolis). He was the recipient of the UWM School of Business Advisory Council Teaching Award, the Reggie Taite Excellence in Teaching Award, and a three-time winner of the Outstanding Teaching Assistant Award at the University of Wisconsin. He is also a recipient of the Elijah Watts Sells Award for Honorary Distinction for his results on the CPA exam. He is a member of the American Accounting Association and the Institute of Management Accountants and has published articles in The Accounting Review, Accounting Horizons, Review of Accounting Studies, Advances in Management Accounting, Managerial Finance, Issues in Accounting Education, Journal of Accounting Education, as well as other journals. His research interests include accounting for financial instruments and innovation in accounting education. He has published papers and given many presentations regarding accounting instruction, and he helped prepare a catalog of critical thinking resources for the Federated Schools of Accountancy.

DONALD E. KIESO, Ph.D., CPA, received his bachelor’s degree from Aurora University and his doctorate in accounting from the University of Illinois. He has served as chairman of the department of accountancy and is currently the KPMG emeritus professor of accountancy at Northern Illinois University. He has public accounting experience with Price Waterhouse & Co. (San Francisco and Chicago) and Arthur Andersen & Co. (Chicago) and research experience with the Research Division of the American Institute of Certified Public Accountants (New York). He has done post doctorate work as a visiting scholar at the University of California at Berkeley and is a recipient of NIU’s Teaching Excellence Award and four Golden Apple Teaching Awards. Kieso is the author of other accounting and business books and is a member of the American Accounting Association, the American Institute of Certified Public Accountants, and the Illinois CPA Society. He has served as a member of the Board of Directors of the Illinois CPA Society, then AACSB’s Accounting Accreditation Committees, the State of Illinois Comptroller’s Commission, as secretary-treasurer of the Federation of Schools of Accountancy, and as secretary-treasurer of the American Accounting Association. Kieso is currently serving on the board of trustees and executive committee of Aurora University, as a member of the board of directors of Kishwaukee Community Hospital, and as treasurer and director of Valley West Community Hospital. From 1989 to 1993, he served as a charter member of the national Accounting Education Change Commission. He is the recipient of the Outstanding Accounting Educator Award from the Illinois CPA Society, the FSA’s Joseph A. Silvoso Award of Merit, the NIU Foundation’s Humanitarian Award for Service to Higher Education, and a Distinguished Service Award from the Illinois CPA Society. In 2003, he received an honorary doctorate from Aurora University.

1. Accounting in Action

2. The Recording Process

3. Adjusting the Accounts

4. Completing the Accounting Cycle

5. Accounting for Merchandising Operations (Perpetual Approach)

5A. Accounting for Merchandising Operations (Periodic Approach)

6. Inventories (Periodic Approach)

6A. Inventories (Perpetual Approach)

7. Fraud, Internal Control, and Cash

8. Accounting for Receivables

9. Plant Assets, Natural Resources, and Intangible Assets

10. Liabilities

11. Corporations: Organization, Stock Transactions, and Stockholders’ Equity

12. Statement of Cash Flows

13. Financial Statement Analysis

14. Managerial Accounting

15. Job Order Costing

15A. Job Order Costing (No Debit and Credit Approach)

16. Process Costing

16A. Process Costing (No Debit and Credit Approach)

17. Activity-Based Costing

18. Cost-Volume-Profit

19. Cost-Volume-Profit Analysis: Additional Issues

20. Incremental Analysis

21. Pricing

22. Budgetary Planning

23. Budgetary Control and Responsibility Accounting

24. Standard Costs and Balanced Scorecard

25. Planning for Capital Investments

Appendices A-F. Apple, Pepsi, Coca-Cola, Amazon.com, Wal-Mart, Louis Vuitton financial statements

Appendix G. Time Value of Money

Appendix H. Payroll Accounting

Appendix I. Subsidiary Ledgers and Special Journals

Appendix J. Other Significant Liabilities