Auditing: A Practical Approach Third Canadian Edition

By Robyn Moroney, Fiona Campbell, Jane Hamilton, and Valerie Warren

Auditing: A Practical Approach provides a concise, practical, and comprehensible option for students studying auditing at an undergraduate and postgraduate level. Fully aligned to the newly revised Canadian Auditing Standards and International Standards on Auditing, this course reflects how a quality audit is conducted in practice and the issues that are of greatest concern to industry professionals.

WileyPLUS with Adaptive Practice for Auditing helps students build their proficiency on topics and use their study time more effectively. It also provides new data analytics content to prepare students for the changing profession.

Schedule a Demo Sign Up for a Test Drive Adopt WileyPLUSWant to learn more about WileyPLUS? Click Here

New data analytics content to prepare students for the changing profession.

To highlight examples where accounting information is used to support business decision-making using of data analytics, we have introduced a new Analytics Mindset feature box and end-of-chapter analytics cases.

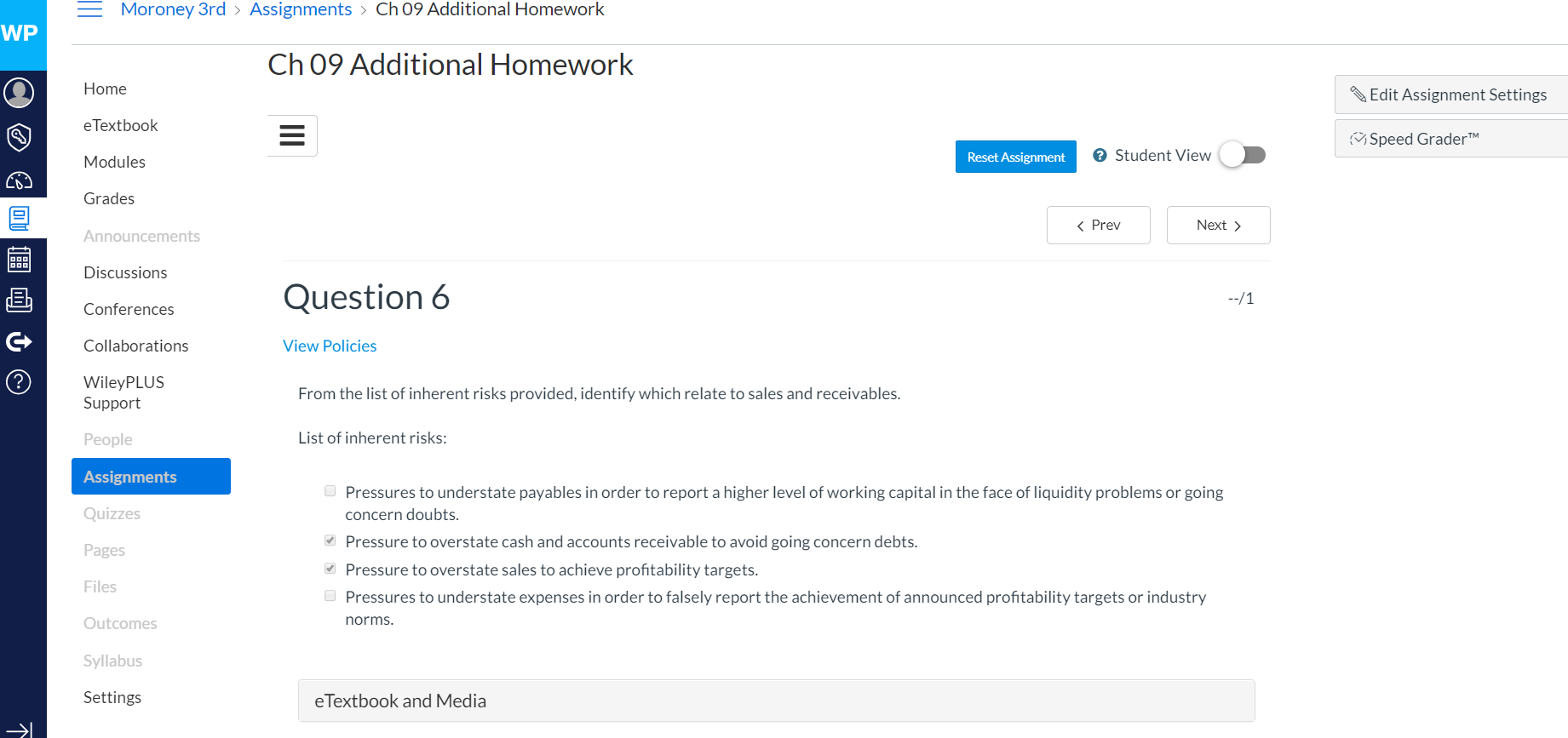

Critical Thinking Questions help students gauge their understanding of the chapter material.

These robust multiple-choice questions encourage the development of higher-level thinking skills. More than the standard four multiple-choice options are provided, and there is more than one correct answer. These comprehensive questions test students’ understanding of a concept and provide detailed solutions and feedback.

Instructors can tailor instruction to individual needs.

Cloud 9 case assignments and, where applicable, accompanying Excel-based working papers with built-in randomization allow instructors to create unique assignments for individual students.

Video content where needed enhances the learning experience.

The Material Matters video series is incorporated throughout the course to provide students with more in-depth explanation of various topics in the related content area.

Robyn Moroney, BEc (Hons), MCom, PhD, CA, CPA, is an Associate Professor in the Department of Accounting and Finance at Monash University. Before commencing her academic career, Robyn worked as an auditor at Arthur Young, now Ernst & Young. With over 25 years of academic experience, Robyn has previously held positions at The University of Melbourne, The University of Auckland, The University New South Wales and La Trobe University. As a member of the board of the Accounting and Finance Association of Australia and New Zealand, which represents the interests of accounting and finance academics in both countries, Robyn has taken on a number of roles including co-chairing the conference technical committee and the doctoral symposium. Her areas of research are in the behavioural (auditor decision-making processes) and economics of auditing fields.

Valerie R. Warren, CPA, CA, MBA, teaches a variety of accounting courses including Auditing; Introductory, Intermediate and Advanced Accounting; and Accounting Theory at the Kwantlen Polytechnic University in Surrey, BC. She also serves as a Practice Review Officer for the Chartered Professional Accountants of British Columbia where she conducts practice reviews of national, regional, and small CA firms to ensure compliance with current accounting and assurance standards are met.

Fiona Campbell, BCom, FCA, is an Assurance Partner with Ernst & Young in Melbourne. Fiona has been serving clients in the Assurance practice since 1991 and has worked on auditing clients in the manufacturing, consumer and industrial products industries as well as not-for-profit sector organizations. She has considerable experience providing professional services to Australian and foreign-controlled companies including large publicly listed and private companies. Fiona is also responsible for assurance methodology and technology at Ernst & Young in Australia and has been involved in designing the firm’s global audit methodology for the past 14 years, including ensuring compliance with both international and local auditing standards.

Jane Hamilton, BBus, MAcc, PhD, is Professor of Accounting at the Bendigo campus of the Regional School of Business, La Trobe University, and previously held academic positions at the University of Technology, Sydney. Jane has twenty years of teaching experience and has published the results of her auditing research in several Australian and international journals.

1. Introduction and Review of Audit and Assurance

2. Ethics, Legal Liability and Client Acceptance

3. Audit Planning I

4. Audit Planning II

5. Audit Evidence

6. Sampling and Overview of the Risk Response Phase of the Audit

7. Understanding and Testing the Client’s System of Internal Controls

8. Execution of the Audit-Performing Substantive Procedures

9. Auditing Sales and Receivables

10. Auditing Purchases, Payables and Payroll

11. Auditing Inventories and PPE

12. Auditing Cash and Investments

13. Completing and Reporting on the Audit