Survey of Accounting, 1st Edition

Paul D. Kimmel and Jerry J. Weygandt

Survey of Accounting is ideally suited for a one-semester introductory accounting course. This program explains accounting concepts without the use of debits and credits, while emphasizing the importance of financial statements and the decision-making process.

The next generation of WileyPLUS for Survey of Accounting gives instructors the freedom and flexibility to tailor content and easily manage their course to keep students engaged and on track.

Schedule a Demo Sign Up for a Test Drive Adopt WileyPLUSWant to learn more about WileyPLUS? Click Here

Solution Walkthrough Videos help students succeed.

Author Paul Kimmel walks students step-by-step through solutions to homework problems. These engaging videos are based on problems similar to the problems students will find in their homework assignments.

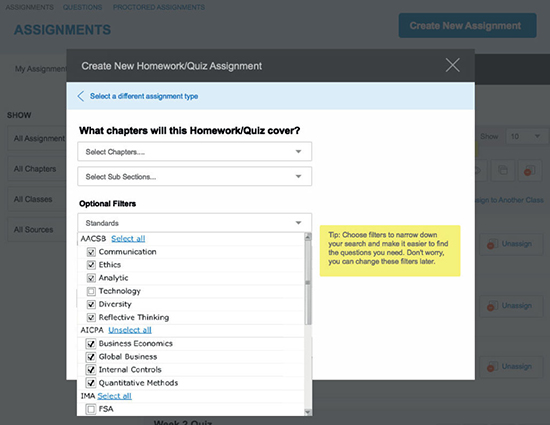

Algorithmic multiple-choice test bank questions make student assessment easy.

All questions are tagged to Bloom’s Taxonomy, AACSB, AICPA, and IMA standards, enabling you to quickly demonstrate outcomes, analyze student performance, and make immediate improvements.

- Interactive Tutorials: Instructors can assign pre-lecture or lecture-replacement assignments and allow students to study anywhere, anytime.

- Real-World Context: Chapter topics are applied to real-world companies with assignable assessment questions.

- Organized Learning: Relevant videos and resources help students make the best use of time outside of class.

- Excel Skills: Students get hands-on practice with relevant Excel functions, while videos teach students the basic steps.

What’s New

Paul D. Kimmel, Ph.D., CPA, received his bachelor’s degree from the University of Minnesota and his doctorate in accounting from the University of Wisconsin. He is an associate professor at the University of Wisconsin-Milwaukee and has public accounting experience with Deloitte & Touche (Minneapolis). He was the recipient of the UWM School of Business Advisory Council Teaching Award, the Reggie Taite Excellence in Teaching Award, and a three-time winner of the Outstanding Teaching Assistant Award at the University of Wisconsin. He is also a recipient of the Elijah Watts Sells Award for Honorary Distinction for his results on the CPA exam. He is a member of the American Accounting Association and the Institute of Management Accountants and has published articles in the Accounting Review, Accounting Horizons, Advances in Management Accounting, Managerial Finance, Issues in Accounting Education, Journal of Accounting Education, as well as other journals. His research interests include accounting for financial instruments and innovation in accounting education. He has published papers and given numerous talks on incorporating critical thinking into accounting education and helped prepare a catalog of critical thinking resources for the Federated Schools of Accountancy.

Jerry J. Weygandt, Ph.D., CPA, is Arthur Andersen Alumni Emeritus Professor of Accounting at the University of Wisconsin-Madison. He holds a Ph.D. in accounting from the University of Illinois. Articles by Weygandt have appeared in the Accounting Review, Journal of Accounting Research, Accounting Horizons, Journal of Accountancy, and other academic and professional journals. These articles have examined such financial reporting issues as accounting for price-level adjustments, pensions, convertible securities, stock option contracts, and interim reports. Weygandt is author of other accounting and financial reporting books and is a member of the American Accounting Association, the American Institute of Certified Public Accountants, and the Wisconsin Society of Certified Public Accountants. He has served on numerous committees of the American Accounting Association and as a member of the editorial board of the Accounting Review; he also has served as president and secretary-treasurer of the American Accounting Association. In addition, he has been actively involved with the American Institute of Certified Public Accountants and has been a member of the Accounting Standards Executive Committee (AcSEC) of that organization. He has served on the FASB task force that examined the reporting issues related to accounting for income taxes and served as a trustee of the Financial Accounting Foundation. Weygandt has received the Chancellor’s Award for Excellence in Teaching and the Beta Gamma Sigma Dean’s Teaching Award. He is the recipient of the Wisconsin Institute of CPA’s Outstanding Educator’s Award and the Lifetime Achievement Award. In 2001, he received the American Accounting Association’s Outstanding Educator Award.

1. Introduction to Financial Statements

2. A Further Look at Financial Statements

3. The Accounting Information System

4. Accrual Accounting Concepts

5. Fraud, Internal Control, and Cash

6. Recording and Analyzing Merchandising Transactions, Receivables, and Inventory

7. Reporting and Analyzing Long-Lived Assets

8. Reporting and Analyzing Liabilities and Stockholders’ Equity

9. Financial Analysis: The Big Picture

10. Managerial Accounting

11. Cost-Volume-Profit

12. Incremental Analysis

13. Budgetary Planning

14. Budgetary Control and Responsibility Accounting

15. Standard Costs and Balanced Scorecard

16. Planning for Capital Investments

A. Apple

B. Columbia

C. VF

D. Double-Entry Accounting System

E. Time Value of Money