Auditing: A Practical Approach with Data Analytics, 1st Edition

By Raymond Johnson and Laura Wiley

The explosion of data analytics in the auditing profession demands a different kind of auditor. Auditing: A Practical Approach with Data Analytics prepares students for the rapidly changing demands of the auditing profession by meeting the data-driven requirements of today’s workforce. Because no two audits are alike, this course uses a practical, case-based approach to help students develop professional judgement, think critically about the auditing process, and develop the decision-making skills necessary to perform a real-world audit. To further prepare students for the profession, this course integrates seamless exam review for successful completion of the CPA Exam.

The next generation of WileyPLUS for Auditing gives instructors the freedom and flexibility to tailor content and easily manage their course to keep students engaged and on track.

Schedule a Demo Sign Up for a Test Drive Adopt WileyPLUSWant to learn more about WileyPLUS? Click Here

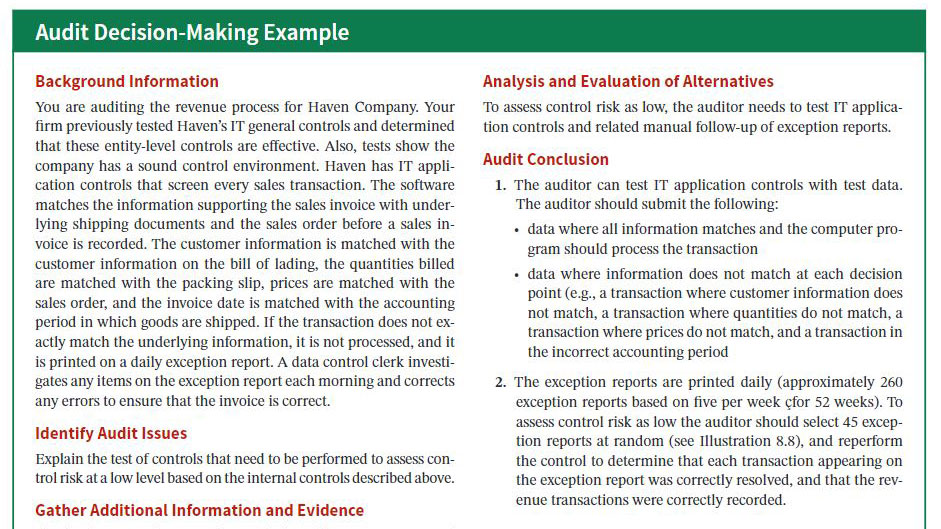

Audit decision-making examples help students develop professional judgement.

Each chapter ends with an audit decision-making example that illustrates a more complex issue out of the chapter. These examples teach students to identify the audit issue, gather information and evidence, analyze and evaluate alternatives, and draw conclusions.

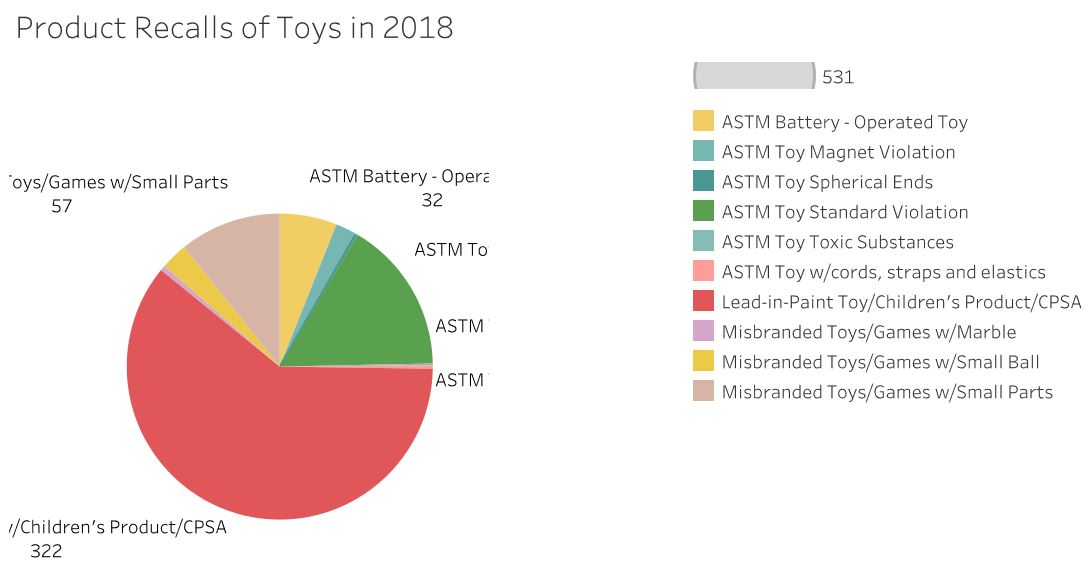

Data analytics is incorporated throughout the course.

In response to the changing demands of the auditing profession, an entire data analytics chapter, as well as additional data analytics content woven throughout the course, helps students understand and apply their learning in a professional environment. Additionally, Tableau and IDEA exercises are included to give students practice in market-leading data visualization software that can be downloaded for free.

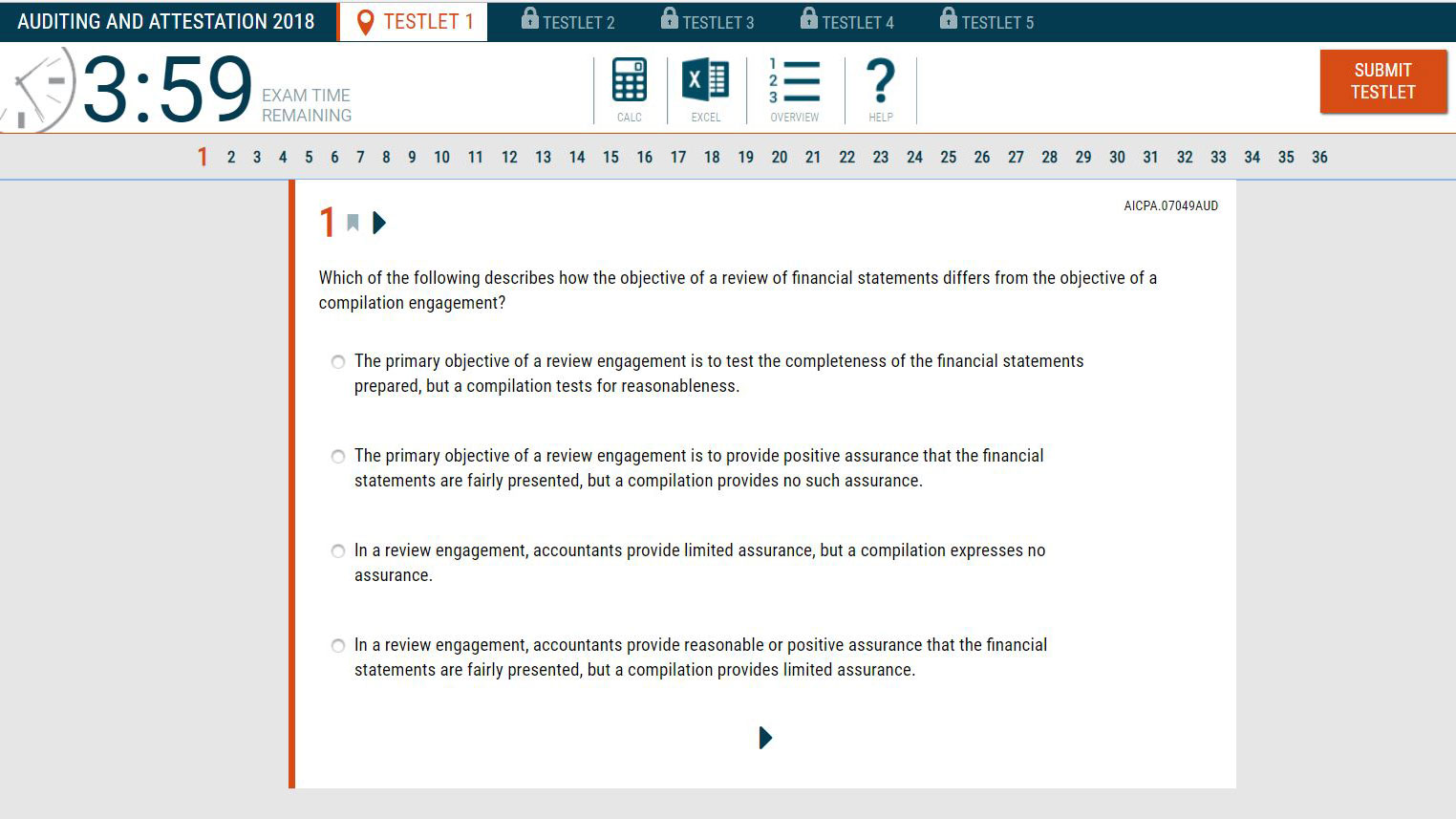

Integrated CPA Exam review prepares students for success.

Seamlessly integrated practice and assessment is available for every chapter through CPAexcel, including assignable task-based simulations, video content, and sample test questions.

Features Include

- Real-World Cases: To support progressive case-based learning, Cloud 9, a continuous case, runs through the body of all chapters. Four additional cases are included in the end-of-chapter material to reinforce critical thinking.

- Practical Approach: In addition to providing all the tools and discussions students need to understand and apply auditing, students are exposed to examples and issues encountered by professionals in today’s auditing environment. Real-world scenarios are presented in homework problems and throughout the course using:

- Audit Reasoning Examples

- Audit Decision-Making Examples

- Professional Environment Discussions

- Working Papers

- Ethics Discussions

- Distinct Visual Assets: The four-color accessible design—including support graphs, figures, and illustrations—clearly demonstrates how an audit is conducted in practice.

- Integrated Assessment: Students understand topics and develop critical thinking skills through the following assessment types:

- Review Questions

- Multiple-choice Questions

- Analysis Problems

- Continuing and Stand-Alone Audit Decision Cases

- IDEA Assignments

- Tableau Assignments

- Bloomberg Video Discussions

- Adaptive Practice: Every student has a different starting point, and adaptive practice provides endless opportunities for practice to effectively prepare for class or quizzes and exams. Active retrieval of information with practice questions is proven to improve retention of information better than re-reading or reviewing the material, and students who use adaptive practice to prepare for exams do significantly better than those who do not. Students begin with a quick, section-level diagnostic to determine their initial level of understanding, and they can use the dashboard and quick reports to see what topics they know and don’t know.

Raymond Johnson is an Oregon CPA and teaches auditing concepts and practices and financial statement analysis at Portland State University. Johnson previously served as staff to the U.S. Auditing Standards Board, he authored an auditing textbook, and he has written numerous academic and professional articles. Most recently he co-authored an article with Gaylen Hansen entitled, “Audit Fees and Engagement Profitability: An Approach to Strengthen Compliance with Standards of Ethical Behavior,” that appeared in the CPA Journal in August, 2011. His current research interests focus on the development of critical thinking skills in the accounting curriculum and on strengthening ethical behavior in the accounting profession. Johnson is the first recipient of the Harry C. Visse Excellence in Teaching Fellowship. He is currently the western region director of the National Association of State Boards of Accountancy (NASBA). He served on the Oregon Board of Accountancy for seven years. Johnson is also a member of the AOICPA Professional Ethics Executive Committee. He is a past chair of the Oregon Board of Accountancy and a past president of the Oregon Society of CPAs. Johnson currently chairs the NASBA Ethics and Strategic Professional Issues Committee. He is also the current NASBA representative on the International Accounting Education Standards Board Consultative Advisory Group and he currently represents the AICPA on the US International Qualifications Assessment Board. He continues to be an active member of NASBA’s Regulatory Response Committee.

Laura Wiley is the assistant department chair of the Louisiana State University (LSU) Department of Accounting and a senior instructor. She came to LSU in 1996 and teaches financial accounting and auditing courses. She also leads a study abroad excursion in the Master of Accountancy program, taking students on educational business trips to Central and South American countries. Wiley is active in the Society of Louisiana CPAs (LCPA) and has served as the chair of the Accounting Education Issues committee since 2014. She received the LCPA’s Distinguished Achievement in Education award in 2015. Wiley has consulted with large and small companies on accounting related matters and conducted onsite training sessions for company employees. Throughout her career, she has also been a presenter at numerous CPE events. Prior to coming to LSU, she was an auditor with PricewaterhouseCoopers in Atlanta, GA. She earned her bachelor’s degree in accounting from The University of Alabama, her master’s degree in accounting from LSU, and her doctorate in human resource education and workforce development from LSU. Her research interests are accounting education and financial literacy. She is an active licensed CPA in the state of Louisiana.

1. Introduction and Overview of Audit and Assurance

2. Professionalism, Ethics and Legal Liability

3. Risk Assessment Part I—Audit Risk and Audit Strategy

4. Risk Assessment Part II—Understanding the Client

5. Audit Evidence

6. Understanding of the Client’s System of Internal Controls

7. Data Analytics—Overview and Application

8. Risk Response—Performing Tests of Controls

9. Risk Response—Performing Substantive Procedures

10. Risk Response—Audit Sampling for Substantive Testing

11. Auditing the Revenue Cycle

12. Auditing the Purchases Cycle and Payroll Cycle

13. Auditing Cash, Inventory, Investing and Financing Activities

14. Completing the Audit

15. Reporting on the Audit