Taxation for Decision Makers, 2017 Edition

By Shirley Dennis-Escoffier and Karen Fortin

The 2017 Edition of Taxation for Decision Makers covers basic taxation of individuals, corporations, S corporations, partnerships, and fiduciary entities, striking the perfect balance between concepts and details. This program is designed for a one-semester, introductory tax course at either the undergraduate or graduate level. The text introduces all tax topics on the CPA exam in only 12 chapters.

The Wiley Engage learning platform for Taxation for Decision Makers delivers an ultimate customization experience not found in any other taxation offerings.

Schedule a Demo Sign Up for a Test Drive Adopt WileyPLUSWant to learn more about WileyPLUS? Click Here

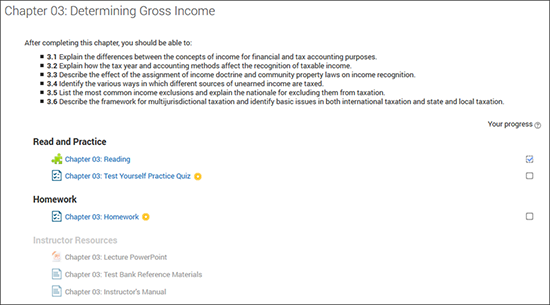

The Wiley Engage learning platform provides course customization.

This platform is Moodle-based, mobile-ready, and completely customizable to restructure the chapter modules, add additional questions or resources, and copy and modify Wiley-authored questions.

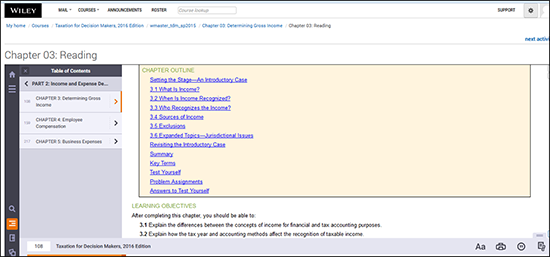

Wiley E-Text: Powered by VitalSource ® makes learning flexible.

The Wiley E-Text is integrated into the online course platform and also available to download for offline use. This flexibility gives students access to course content anytime, anywhere.

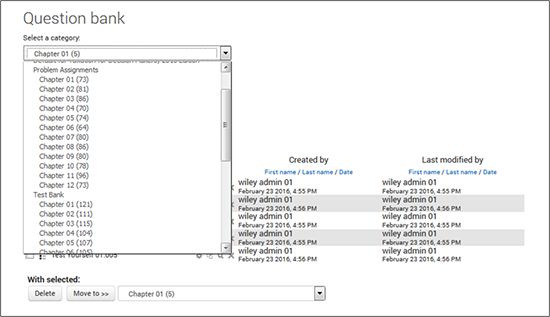

A variety of question types reach all types of learners.

Question types include practice tests, end-of-chapter questions, and test banks, which have multiple-choice, true-false, essay, multi-part, matching, text entry, text entry numeric, and algorithmic question types. All questions include feedback and information for graders. Numeric questions include a tolerance.

Shirley Dennis-Escoffier is an associate professor at the University of Miami, where she teaches both graduate and undergraduate tax classes. She received her Ph.D. from the University of Miami (UM) and returned to UM after teaching at the University of Hawaii and California State University in Hayward. She is a Certified Public Accountant licensed to practice in Florida. She was a former president of the American Taxation Association and remains actively involved with the American Institute of Certified Public Accountants. She has received several teaching awards and published numerous articles in tax and accounting journals. Shirley is the recipient of an Ernst & Young Foundation tax research grant.

Karen A. Fortin retired from her position as Professor of Accounting and Taxation at the University of Baltimore, where she had been Department Chair and taught graduate and undergraduate tax classes in both the Business School and the Law School. She received her Ph.D. from the University of South Carolina and held teaching positions at the University of Wisconsin-Milwaukee and the University of Miami. She was a Wisconsin Certified Public Accountant and a recipient of a Sells Award. During her teaching years, she was active in the American Taxation Association and the American Accounting Association as an editor, reviewer, and chairperson for numerous events. She has published numerous articles in tax and accounting journals and has co-authored and edited a number of textbooks.

Part I: Introduction to Taxation and Its Environment

Chapter 1: An Introduction to Taxation

Chapter 2: The Tax Practice Environment

Part 2: Income and Expense Determination

Chapter 3: Determining Gross Income

Chapter 4: Employee Compensation

Chapter 5: Income Taxation of Individuals

Chapter 6: Business Expenses

Part 3: Property Concepts and Transactions

Chapter 7: Property Acquisitions and Cost Recovery Deductions

Chapter 8: Property Dispositions

Chapter 9: Tax-Deferred Exchanges

Part 4: Business Taxation

Chapter 10: Taxation of Corporations

Chapter 11: Sole Proprietorships and Flow-Through Entities

Part 5: Taxation of Individuals

Chapter 12: Wealth Transfer Taxes

Appendix A: Tax Rate Tables